Obligations to report passport or address changes to the Panama National Immigration Services

Failure to report new passports, a change in their address, or any other variation in the information provided during the registration process with the Panama National Immigration Service will result in a fine.

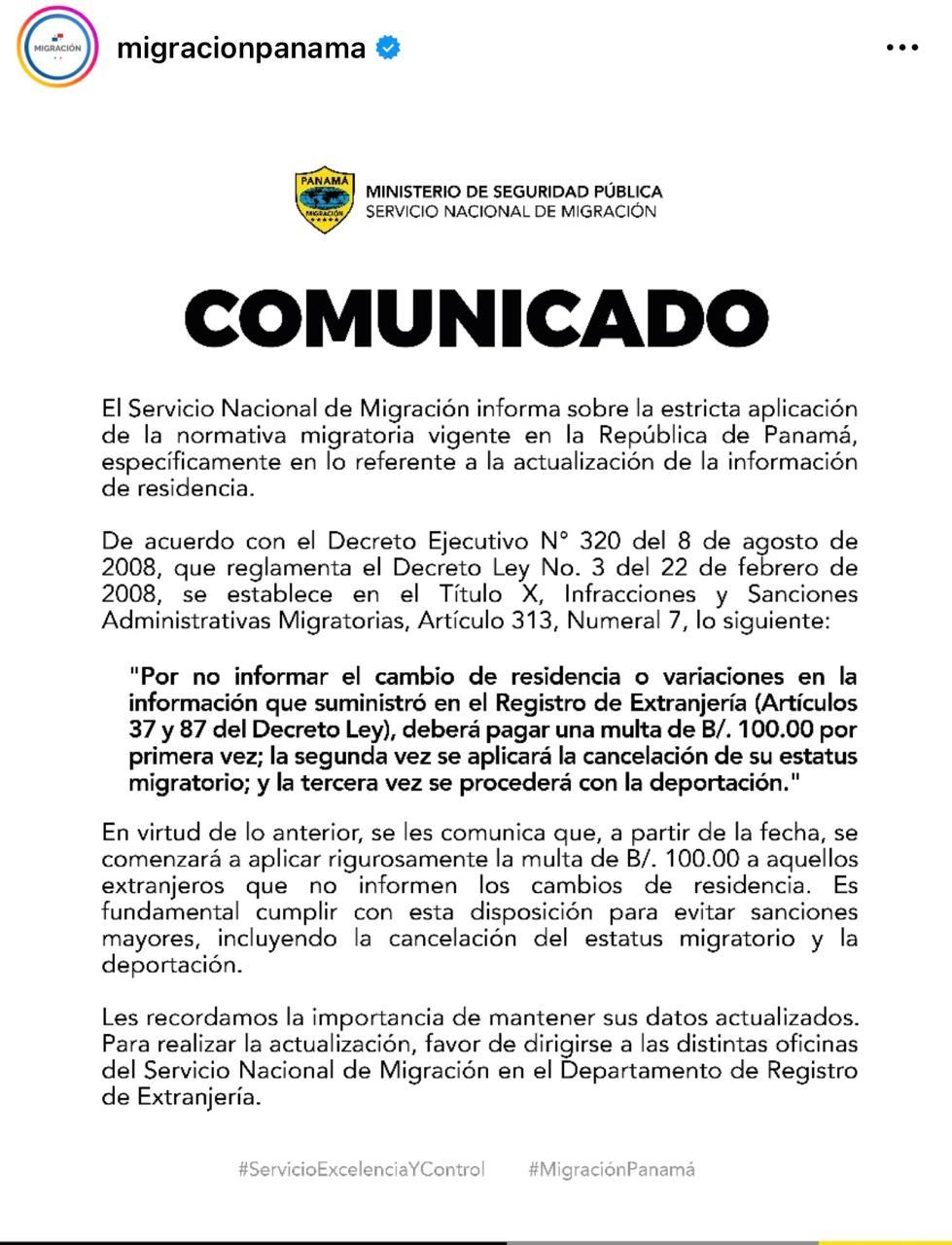

The National Immigration Service (SNM) has issued a statement announcing that foreigners who fail to report their new passport, change in domicile, or any variation in the information provided to the National Immigration Service during the Registration Process will be fined. This as per Executive Decree No. 320 of August 8, 2008, which regulates Decree Law No. 3 of February 22, 2008, which establishes in Title X on Administrative Immigration Violations and Sanctions, Article 313, Section 7, that Failure to report a change of residence or changes in the information provided to the Immigration Registry (Articles 37 and 87 of the Legislative Decree) will result in a fine of B/100.00 the first time; the second time, the immigration status will be canceled; and the third time, deportation will be imposed.

Also, Articles 37 and 87 of Legislative Decree No. 3 of 2008 state that:

Article 37. Foreigners are required to report any change in the information they have provided to the Immigration Registry within thirty calendar days, counting from the day the reason for the change arises. For personal notification purposes, the National Immigration Service will consider the address reported in the Immigration Registry as valid.

Article 87. Foreigners who have acquired immigration status as a temporary or permanent resident in the national territory are required to inform the National Immigration Service of any change of residence or changes in the information provided to the Immigration Registry. Anyone who fails to comply with this obligation will be fined one hundred balboas the first time; a repeat offense may result in the cancellation of the residence permit and deportation from the national territory.

In conclusion, if you fail to report your new passport, change of address, or any change in the information provided to the SNM, the penalties will be applied as follows:

- First time - USD 100.00

- Second time - Immigration Status Cancellation

- Third time - Deportation